Are you ready to take your crypto trading to the next level? Mastering technical analysis is a crucial skill for any successful trader in the crypto world.

By analyzing market data and identifying patterns, you can make informed decisions about when to buy and sell, ultimately maximizing your profits.

In this article, we’ll explore the basics of technical analysis, including the tools and strategies you need to develop a solid trading plan.

Whether you’re a seasoned pro or just starting out, mastering technical analysis is essential for staying ahead of the curve in the fast-paced world of crypto trading.

So let’s dive in and discover how you can take your trading game to the next level!

Related Video: "Technical Analysis is Hard (until you see this)" by Max Maher

Table of Contents

Key Takeaways

– Technical analysis tools such as candlestick charts, moving averages, relative strength index, divergence patterns, and chart patterns are crucial for successful crypto trading.

– Developing a trading plan with goals, risk management strategies, and market psychology is essential.

– Continuous learning and staying up to date with the latest trends and developments are critical to success.

– Market psychology studies how traders and investors behave in the market and can provide valuable insights for successful trading.

Understanding the Basics of Technical Analysis

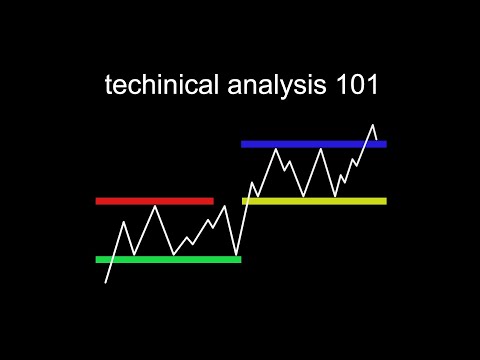

You’ll need to understand the basics of technical analysis if you want to make informed decisions when it comes to crypto trading. This involves analyzing charts and identifying patterns to predict future market movements.

One of the key aspects of technical analysis is trend identification. This means looking at the direction that an asset’s price is moving and determining whether it’s going up, down, or sideways.

Another important aspect of technical analysis is chart patterns. These are recurring formations that can indicate a potential change in market direction. Some common chart patterns include head and shoulders, triangles, and flags.

By understanding these patterns and what they can signify, you can make more informed decisions when it comes to buying and selling cryptocurrencies.

Developing a Trading Plan

Funny how some traders think they can wing it without a solid plan in place, isn’t it? Developing a trading plan is essential to your success as a crypto trader. It helps you to stay focused, disciplined, and organized in your trading activities.

Your plan should include your trading goals, risk management strategies, and market psychology. Your trading goals are what you want to achieve from your trading activities. It could be to make a certain amount of profit, to trade a certain number of times in a day, or to enter and exit the market at specific price levels.

Risk management strategies are crucial to protecting your capital from losses. You should have a plan in place for managing your risk, such as setting stop-loss orders and taking profits at predetermined levels.

Lastly, market psychology is the study of how traders and investors behave in the market. Understanding market psychology can help you to make better trading decisions and avoid common mistakes. Incorporating these elements into your trading plan will help you to achieve your goals and become a successful crypto trader.

Using Technical Analysis Tools

If you want to improve your crypto trading skills, you need to be familiar with technical analysis tools.

Candlestick charts are a popular tool that can help you visualize market trends and patterns.

Moving averages can help you identify the direction of the trend, while the Relative Strength Index (RSI) can help you gauge the market’s momentum.

By mastering these key points, you can make better-informed trading decisions and increase your chances of success.

Candlestick Charts

By analyzing candlestick charts, you can gain insight into the market trends and make informed decisions based on the visual representation of price movements. Candlestick charts are a type of financial chart used by traders to represent the price movements of an asset.

They are made up of individual candles that represent a specific time period, such as a day or an hour. Reading patterns on candlestick charts can help traders identify trends and make more accurate predictions about the future movements of an asset.

For example, a long green candle indicates that the price of an asset has risen significantly over a certain time period, while a long red candle indicates that the price has fallen. By identifying patterns in these candles, traders can make informed decisions about when to buy or sell an asset, which can help them earn profits in the volatile world of cryptocurrency trading.

Moving Averages

Moving averages can be a useful tool for traders to identify trends in an asset’s price movement over a certain period of time. For example, the 50-day moving average can indicate a strong uptrend in a stock’s price.

This is because a moving average calculates the average price of an asset over a specified period. When the price is consistently above the moving average, it suggests that the asset is in an uptrend.

To make the most of moving averages, you can use a crossover strategy. This involves looking at the intersection of two moving averages with different time periods. For instance, when the 50-day moving average crosses above the 200-day moving average, it signals a bullish trend. You may want to consider buying the asset.

Conversely, when the 50-day moving average crosses below the 200-day moving average, it suggests a bearish trend. You may want to consider selling the asset.

Additionally, exponential moving averages give greater weight to recent price movements. This makes them more responsive to current market conditions. Incorporating these strategies can help you make more informed trading decisions.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a powerful tool for identifying overbought and oversold market conditions, allowing traders to make informed decisions about when to buy or sell assets. It is a technical indicator that measures the momentum of price movements, and is plotted on a scale of 0 to 100. The RSI is calculated based on the average gains and losses of a specific period, usually 14 days. When the RSI is above 70, it is considered overbought, indicating that the asset is likely to experience a price correction. Conversely, when the RSI is below 30, it is considered oversold, indicating that the asset is likely to experience a price increase.

To make the most of the RSI, traders should look for divergence patterns, which occur when the RSI and the price of an asset are moving in opposite directions. This can be a strong signal that a trend reversal is imminent. For example, if the price of an asset is trending upwards while the RSI is trending downwards, it could indicate that the asset is becoming overbought and is due for a correction. Conversely, if the price of an asset is trending downwards while the RSI is trending upwards, it could indicate that the asset is oversold and is due for a price increase. By using the RSI in conjunction with other technical indicators, traders can gain a more comprehensive understanding of market conditions and make more informed trading decisions.

| RSI Reading | Market Condition |

|---|---|

| ———– | —————- |

| Above 70 | Overbought |

| 50-70 | Neutral |

| Below 30 | Oversold |

| Divergence | Trend reversal |

| Strong RSI | Strong momentum |

Continuous Learning and Improvement

Don’t miss out on opportunities to improve your crypto trading skills – keep learning and practicing! Remember that the world of cryptocurrency is constantly evolving, and staying up to date with the latest trends and developments is critical to your success.

Take the time to read relevant news articles, attend webinars, and join online communities where you can exchange ideas with other traders.

In addition to staying up to date, it’s also important to have patience and be willing to learn from your mistakes. No trader is perfect, and losses are inevitable. However, by analyzing your trades and identifying areas for improvement, you can continuously refine your strategy and increase your chances of success.

Investing in your education and taking advantage of opportunities to learn and improve will pay off in the long run, and help you achieve your crypto trading goals.

Frequently Asked Questions

What are some common mistakes beginners make when using technical analysis in crypto trading?

You might think technical analysis is easy, but common mistakes can cost you. Don’t expect to master it overnight. Practice is essential to avoid errors and achieve success in crypto trading.

Can technical analysis be used for short-term as well as long-term trading strategies?

You can use short term and long term technical analysis for trading strategies, each with its own benefits and drawbacks. Advanced technical analysis indicators and signals can help with both, but require experience and knowledge.

How important is it to consider fundamental analysis alongside technical analysis when making trading decisions?

When making crypto trading decisions, it’s important to consider both fundamental and technical analysis. Integrating these two approaches can provide a more comprehensive understanding of market trends and potential opportunities.

Are there any technical analysis tools that are specifically designed for crypto trading?

If you’re looking to trade cryptocurrencies, there are several crypto trading indicators and tools you can use to analyze price movements and make informed decisions. Some of the best technical analysis tools for crypto trading include moving averages, MACD, and RSI.

What are some advanced technical analysis techniques that experienced traders use in crypto trading?

Experienced traders use Fibonacci retracements and candlestick patterns for advanced technical analysis in crypto trading. Did you know that over 60% of traders use Fibonacci retracements? Use these techniques to improve your trading strategy.